Are you still using manual and paper-based processes for managing loan operations?

The traditional ways of lending resulted in longer decision times and opacity for customers. It was imperative for banks and institutions to digitize the lending process. Disparate legacy systems and disintegrated workflows created many unsatisfied customers who consistently demand faster outcomes.

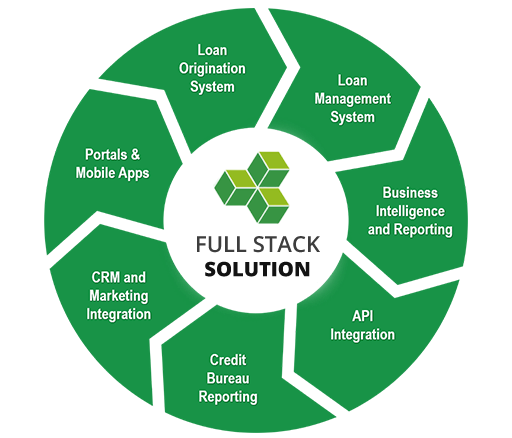

LendFoundry has brought digital transformation into the end-to-end loan origination and loan management process, enabling easy approval and disbursal of loans. Instead of creating a product on top of 3rd party technologies, LendFoundry has built upon a scalable, robust, full-stack technology platform based on a micro-service architecture design. This platform empowers the merchants and lenders to access an alternative financing model where they can conveniently service their customers, monitor the loan portfolios while maintaining compliance and mitigating the risks.

LendFoundry can integrate with 60+ third-party providers like ADP, DocuSign, Experian Credit, Email service providers, etc. which enables a whole ecosystem of independent loan services. It is a fintech accelerator for alternative financing and can be a great solution for startups and ventures. It caters to asset management through personal loans, merchant cash advance, and working capital solutions.

Salesforce and LendFoundry integration takes place through a pre-configured API-rich lending ecosystem using Salesforce Sites. This Salesforce integration allows you to streamline your business and manage every operation from inside the CRM view and also generate actionable insights.

Are you looking for expert Salesforce integration services? Look no further!

Integrating Salesforce with LendFoundry has led many businesses to achieve:

- 75% reduction in turnaround time for loan closures (24 hours vs 5 ~12 days)

- 20% increase in conversion rates & hence, improved ROI on marketing spend

- 35% savings in the cost of managing operations (underwriting, sales, support)

Algoworks is a Salesforce Gold Consulting Partner and we can help you realize the potential of such a powerful integration. We have over 10 years of experience in implementing CRM integrations aided by an efficient team of Salesforce app development experts and architects.