The safest option for online business transactions – PayPal?

PayPal started out as Confinity in 1998 and became the default payment partner for most businesses with the emergence of globalization in e-commerce solutions. It is one of the safest and quickest ways to support your online transactions with an estimated 400 million users across the world. PayPal’s business model is state-of-the-art to enable safe transactions between buyers and sellers.

How important are financial services in today’s date and age?

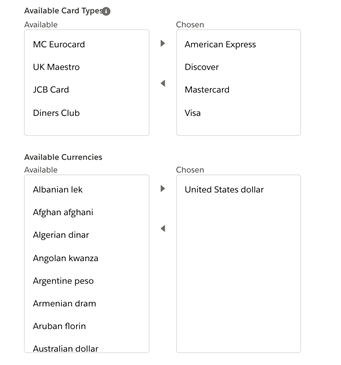

Financial services are an important tool for economic growth and access to it creates opportunity. PayPal has practically vowed to democratize financial services and empower businesses. Today, most businesses offer PayPal as a means of managing and moving money with availability across online platforms in 200 countries. It enables consumers and businesses alike to transact in over 100 currencies and hold the balance in their PayPal wallets in 25 currencies.

PayPal as a Salesforce Commerce Cloud partner

Is it even worth asking why Salesforce would partner with PayPal? PayPal has had a lot of strategic partnerships and technological innovation over the years which made it such an important multi-currency player in the payments industry. Salesforce Commerce Cloud B2B and B2C enable some of the best brands in the world to deliver smart and secure experiences to shoppers.

Integration with PayPal cartridge

PayPal cartridge can be seamlessly integrated with Salesforce which brings with it the best of features to global brands and leaders in the e-commerce industry helping them grow their sales manifold and reduce the operating costs.

Some of the most implemented APIs are:

- PayPal and PayPal Credit components provide support for PayPal Express Checkout from Cart

- PayPal Express Checkout from the Payment page

- IPN (Instant-Payment-Notification)

- In-Context Checkout, PayPal One Touch, and various standalone API calls, making the sales funnel simpler

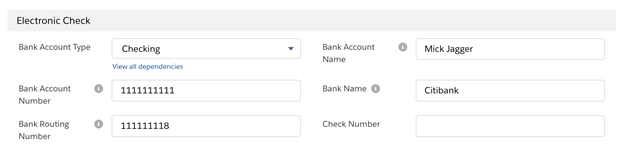

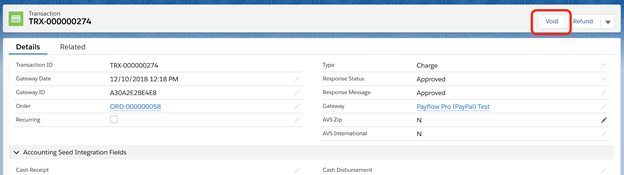

- PayPal Website Payments Pro with transactions posted automatically to Salesforce

With the apposite integration of PayPal and Salesforce, online transactions can be automatically recorded on the cloud platform. The robust integrating services also enable you to construct fresh opportunities directly from PayPal sales and sync them with Salesforce contacts. The PayPal integration CRM tool also empowers you to add the messaging and notification system for fresh Salesforce contacts.

PayPal Solution Approach (Use Cases)

1. Use PayPal Instant Payment Notification (Real-time data integration) – Recommended Approach:

We can go with this IPN (instant payment notification) offered by PayPal and connect PayPal to Salesforce directly via a Salesforce site and custom Salesforce REST API. Configuration changes in PayPal to setup Salesforce API endpoint.

Benefits and Risks

- Benefit: This solution is dependent on the “Salesforce site” and all data entry to the Salesforce database will be routed using the site guest user license. Data syncing will be real-time and will be triggered based on the payment event notifications coming from PayPal. This is the most direct, affordable, and recommended solution.

- Disadvantage and Risk: Salesforce keeps updating its policies and it may put restrictions on Salesforce Site in the future. If and when that happens and the conditions change, we will invoke the second solution listed below. LVP has the choice to implement the second solution upfront or invoke it at a later time if needed.

2. Use PayPal REST API to pull data from PayPal into SF (Time-interval based):

We will design and develop a new Salesforce Apex batch class to PULL all the transactions made at the client’s PayPal account at a specified Interval depending upon how frequently the client wants to sync such transactions. Writing a batch class in salesforce to authorize PayPal’s connected app and fetching the transaction at a given interval of time. Develop a schedulable class for Cron jobs management (Every 30 mins or, as required by Client). Writing custom apex code for Refresh token management.

Benefits and Risks

- Benefit: This solution is more long-lasting than solution 1 as the APIs generally remain evergreen and stable. However, it will NOT be real-time and the synching will run on time intervals.

- Disadvantage and Risk: More custom code and complex API integration need to be done. No risk that we could think of.

Looking for Salesforce integration services? Contact us today!